If you want to read via the website, please click the link "http://tempuri.org/tempuri.html"

MARKET OVERVIEW

In Asia, spot MMA prices have stabilized, largely because they

have already reached the bottom and most producers have no room for further

decreases. However, weak downstream affordability and sluggish global market

demand continue to negatively impacted by several geopolitical events, including

Israel's invasion of Palestine and the ongoing Russia-Ukraine war. In addition,

reciprocal U.S. tariffs have undermined market confidence and driven MMA

operating rates to unprecedented lows. Market demand for MMA remains tepid,

with many buyers in no rush to purchase, citing sufficient inventories and

unfavorable margins. This resistance reflects broader concerns about a

prolonged economic slowdown. Consequently, the market faces a significant

challenge as most buyers have scaled back MMA purchases, adopting a cautious

"wait-and-see" approach while anticipating weaker demand from Europe

and the U.S. Actual trade activity remains subdued, pressured by low localized

MMA prices and high U.S. tariff costs. Looking ahead, overall MMA supply is

expected to remain constrained, with most producers limiting transactions and

focusing on replenishing their lean inventories. Nevertheless, market

participants are cautiously optimistic that the long-running US-China trade

conflict-now in a negotiation phase since late September-together with the

one-point U.S. interest rate cut on September 18, will help support market stability

or even growth in the fourth quarter of 2025. Separately, Indonesia has faced

significant political and natural disruptions. On August 29, in Jakarta,

student protests against alleged parliament corruption escalated into violent

clashes with riot police, resulting in the death of a deliveryman. This

incident sparked widespread demonstrations across Jakarta, Surabaya, Sigang,

and other parts of Indonesia. Although the situation has eased since

mid-September, and the government has implemented reforms, reports indicate

that the unrest has not been fully resolved. Additionally, extreme weather has

further impacted regional markets. According to Abdul Muhari, spokesman for

Indonesia's National Disaster Mitigation Agency (BNPB), heavy rains beginning September

9 triggered floods and landslides in seven districts of Bali. The disaster has

claimed 19 lives, with five more still missing and over 500 residents

displaced. Schools, village halls, and mosques have been converted into

temporary shelters. The

outlook for MMA prices in November is expected to remain steady to weak. A meaningful recovery in demand–rather than further supply-side

adjustments–will be needed to drive sustained improvement. As such, prices are

likely to stay stable or only slightly higher in the near term.

FEEDSTOCK

On the feedstock

side, US-China trade war truce announced there would be a further 90-day

extension in August. OPEC released the report on August 12, in which the 2025

demand growth forecast remains at 1.3MMb/d, while lifting 2026 to 1.4 MMb/d. Meanwhile,

the IEA also reported that demand growth is forecasted to be lower at 0.68

MMb/d in 2025 and rise by 0.70 MMb/d in 2026. Tariffs and sanctions continue to

drive the market, while Ukrainian drone attacks on Russian oil infrastructure have

added uncertainty. The Trump-Putin summit in Alaska didn’t provide any clear

directions towards ending the Russia-Ukraine war. Additional pressure has also

come from OPEC+ production increases and weakening demand expectations. Bearish

fundamentals have weighed on prices. International oil prices have remained relatively

stable. By September 25, crude oil was in the range of US$64-70 per barrel,

with ICE Brent at US$64.99/bbl and WTI at US$69.31/bbl. Upstream, downstream demand forecasts and subdued economic

sentiment have been reflected in the oil markets. With summer blending

specifications and reduced steam cracker operations, the naphtha market has found

some support, gaining relative strength against crude oil. Naphtha prices have stabilized

at US$570 ~600 pmt CFR NE Asia. In olefins, Asian spot ethylene prices slightly

increased to US$S$840~860 pmt CFR SE Asia, pushing MTBE prices higher to US$670~700

pmt CFR Asia. In Southeast Asia, demand remains sluggish, mainly driven by reduced

PP operating rates and derivative units focusing on building their own

inventories. The propylene market is expected to become more balanced, with spot

sentiment improving slightly to US$780~800/mt CFR Taiwan. For acetone, prices

have bottomed out. Despite losses earlier, market has stabilized, hovering at US$530~570

pmt CFR China. Methanol prices have also stabilized at US$310~330 pmt CFR

Taiwan. In the MMA market, even though feedstock costs have declined in recent

months, MMA prices have fallen more sharply than costs. This has created a

challenging environment for producers, who must balance covering margins while

facing resistance from buyers focused on their own profitability.

PRODUCTION

In

Europe, MMA market demand remains subdued, with spot prices declining in

September amid ample low-cost imports. This downturn has been driven by weak automotive

production and persistent uncertainty among end consumers. Buyers continue to

destock, with demand largely covered by contract volumes, leaving spot market

activity limited. Geopolitical tensions, including the Gaza crisis and strained

US-Iran relations, have further weighed on sentiment. Adding to regional

instability, anti-immigrant protests erupted in the Netherlands. On September

12, the UN General Assembly adopted a resolution, backed by 142 countries, in support

of the New York Declaration, which calls for a peaceful resolution to the

Palestinian issue through a two-state solution. Recognition of the State of

Palestine by the United Kingdom, Canada, Australia, Portugal, and France has

further intensified the debate. In the UK, London Heathrow was among several

European airports that experienced delays Saturday (on September 20) due to a

cyberattack affecting electronic boarding pass and baggage systems. The

widespread disruptions continued into Sunday. From a market perspective, some

producers anticipate a slight uptick in demand ahead of the coatings season,

leading many to announce price rollovers. However, final agreements remain

dependent on MMA purchase volumes during negotiations. On the production side,

Röhm GmbH announced a planned maintenance shutdown at its MMA plant in Worms,

Germany, scheduled from October 24 to November 24.

In the

US, MMA supply and demand remain stable. Downward price pressure persists

amid local competition, with no major concerns about supply despite two

producers planning turnarounds. However, MMA import prices from Asia have declined,

while volumes remain constrained by US tariffs. Domestic demand appears

relatively steady, though US homebuilder confidence stayed low in September as

contractors contend with rising construction costs, even as mortgage rates begin

to ease. Buyers are closely watching monetary policy, as the US Federal Reserve

lowered its benchmark interest rate by a quarter point amid a weakening job

market and elevated inflation, and it expects to implement two more cuts before

the end of this year. Additionally, US President Donald Trump has signed an

executive order imposing a $100,000 annual fee on H-1B visa applicants, up

significantly from the current cost of around $1,500. On the supply side,

average upstream acrylonitrile (AN) operating rates in the Americas were

estimated at 70% , up 1% from the previous month, with MMA production rates expected

to rise to 65~75%. Key developments include the following: Dow 425 kpt MMA

plant in Deer Park is scheduled for a one-month turnaround in October; MCM is

planning a six-week maintenance shutdown in Q4. Röhm’s proprietary 250kpta LiMA

MMA technology plant in Bay City, Texas, is now operational.

In Asia, MMA spot prices remains stable, but buying interest is lackluster due to sufficient stock levels amid subdued market sentiment. Buyers are largely maintaining lean inventory and

focusing on fulfilling existing contractual obligations rather than engaging in

spot purchases. Volatility in China’s domestic pricing is expected to affect not

only finished product exports but also MMA prices from China. Producers remain

cautious about pricing, as low production and limited inventories among both

suppliers and end users continue to add pressure. In Taiwan and South Korea,

market demand remains weak, with ample supply leading buyers to primarily

source locally. MMA availability across Asia remains relatively balanced, with

current operating rates estimated at 50–60%, as reports indicate several MMA

plants have reduced output or scheduled shutdowns in Q4.

CHINA MARKET OVERVIEW

Following the October 1 National Day holiday, the domestic MMA market showed

a meaningful recovery, largely driven by restocking activity ahead of the break.

Domestic MMA prices surged by RMB 500~1,000mt before the October 1~8 holiday,

supported by newly commissioned PMMA plants that increased MMA consumption. However,

buyers are expected to push for price reductions beyond feedstock cost movement

in order to compress supplier margins, making it too early to determine where

the market will ultimately settle. The buyer pressure comes as the industry

enters Q4, traditionally the weakest quarter due to year-end holiday slowdowns.

FOB China offers have been firm, with indicative prices around US$1,180/mt. Domestically,

ex-works MMA prices were reported at CNY 10,000–10,500/mt by the end of

September. Adding to market challenges, on September 10, the Mexican government

announced plans to raise tariffs on auto imports from China and other Asian

countries to 50%. Analysts told Reuters the move was intended to appease the

United States. Economy Minister Marcelo Ebrard emphasized that "without a

certain level of protection, competition is almost impossible," justifying

the increase from approximately 20% to a maximum of 50%. He added that the

measure-still requiring congressional approval and aligned with WTO ceilings-aims

to protect jobs and counter the influx of lower-priced Chinese auto models into

the Mexican market.

On the supply side, most MMA producers have maintained operating rates between

55 and 70%. Several planned shutdowns are as follow:

1. PetroChina Jilin - reduced operating

rates between September and October.

2. Shenghong Group, Jiangsu Sierbang

Petrochemical Co., Ltd - 340kpta MMA plant in Lianyungang scheduled for

one-line to shutdown.

3. Panjin Sanli 50kpta C2-process MMA

plant in Liaoning planned for shutdown.

4. Dongying Yingke Chemical’s 50 kpta MMA

plant in Shandong is scheduled for shutdown.

DOWNSTREAM

On the PMMA side, demand remains dismal, weighed down

by ample finished product inventories and limited restocking activity ahead of

the Golden Week holiday beginning October 1. Import interest among China-based

PMMA users has also been subdued. Against the backdrop of lackluster demand, buying

and selling activity often reaches a pricing stalemate. Most PMMA producers

remain reluctant to further squeeze margins, though some have managed to offset

losses through the stronger profitability of MMA, which remained firm through

the end of September. In China, domestic market demand remains gloomy. Upstream

methyl methacrylate (MMA) prices rose by Chinese yuan (CNY) 500/mt ~ 1,000/mt,

bringing the range to Chinese yuan (CNY) 10,000/mt ~ 10,500/mt DEL. However, PMMA

prices stayed largely flat, holding around Chinese yuan (CNY) 12,000/mt ~ 13,000/mt

EXWH for domestic material, while imported material was mostly unchanged at Chinese

yuan (CNY) 13,500/mt ~ 14,500/mt EXWH during the same period. Across Asia, the

PMMA market has been relatively stable, with the spot prices for

general-purpose (GP) PMMA in Southeast Asia assessed at US$1,700-1,800/mt CFR

SE Asia.

On the acrylic sheet side, market demand in

under significant pressure as export orders have shrunk considerably. Most

buyers are waiting for order confirmations and consuming existing cast sheet inventory

before resuming procurement. In Indonesia, demand appears stable, though the political

turmoil in August, with reduced export orders affecting MMA offtake for September-October

shipment. In Vietnam, lacklustre domestic demand from end-user sectors has been

offset by squeezed margins, prompting significant downward pressure on cast

sheet pricing. Cast sheet makers continue to voice dissatisfaction, citing weak

downstream affordability as an ongoing downside risk and most have maintained

low production rates recently. In Taiwan, sluggish domestic demand has also led

producers to further reduce operating rates. On September 28, a fire broke out

at the Huaqi Acrylic Factory in Rende, Tainan, which completely burned down, though

fortunately no one was injured. In Thailand, supply remains stable, but cast

sheet producers have likewise scaled back production in response to subdued

end-user consumption. Currently, cast sheet prices across the region are

currently ranging from US$2.05~2.30/kg CFR, reflecting a balanced yet cautious

market outlook as participants navigate ongoing supply chain and demand-side

pressures.

On the resin side and others, demand from the ABS sector has increased slightly; However, markets have

deteriorated further under the weight of oversupply and rapid inventory

buildup. This has drained speculative interest and discouraged buyers from

engaging in forward purchases. Confidence in the ABS market has weakened as

fundamentals continue to soften. Despite weaker order expectations in Q4,

industry association data indicate that exports of large household

appliances—including refrigerators, washing machines, and air conditioners—rose

6.2% year-on-year in revenue terms. Most ABS producers are striving to maintain

optimal operating rates. However, producers in Taiwan and Korea face greater

challenges in scaling up output amid weaker market conditions. Without the

benefit of economies of scale, their production costs remain higher. This has

contributed to a surge of competitive offers from mainland China, further

weighing on the regional market, while producers outside mainland China continue

to face mounting challenges. Demand from the acrylamide sector has held steady,

with producers maintaining low operating rates to manage inventory. Acrylamide

prices remain flat. Demand from the NBR sector has also remained stable, with

NBR prices fluctuating within a narrow range. Additionally, the 59th Annual

Meeting of the European Petrochemical Association (EPCA 2025) will be held in

Berlin from September 22 to 25. In India, a prolonged monsoon season combined

with an earlier Diwali this year is diminishing the likelihood of a significant

seasonal demand recovery compared to previous years.

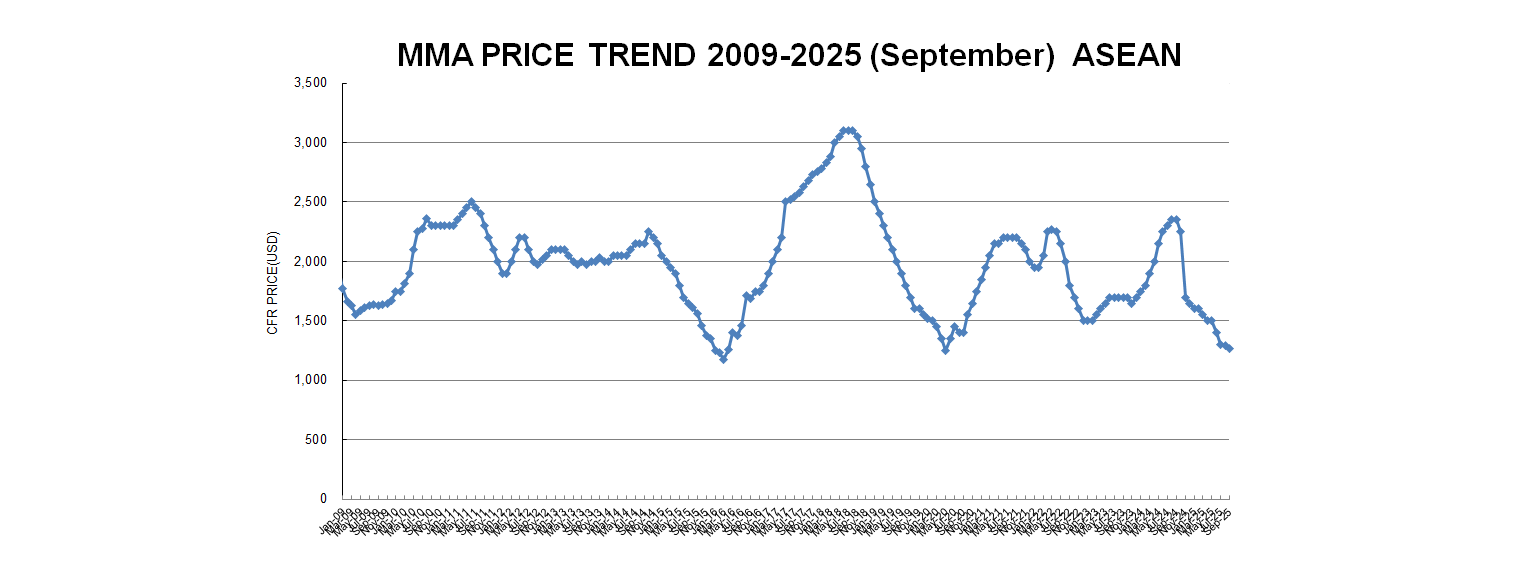

MMA PRICE

|

US$/mt

|

|

September 2025 Price Range

|

August 2025 Price Range

|

|

Asia contract

prices for cargos ≦ 200mt or more

|

|

1,210~1,280

|

1,220~1,290

|

|

Asia spot prices

for 20~200mt

|

|

1,260~1,310

|

1,270~1,320

|

If you need more information or quotation, please contact with spencer_hsieh@borica.com or john_chang@borica.com